Asset Disposal Journal Entry

420 Exit or Disposal Cost Obligations 450 Contingencies 450-20 Loss Contingencies 450-30 Gain Contingencies. Must recognize the gain from the sale.

Fixed Asset Accounting Made Simple Netsuite

If the asset is fully depreciated you can sell it to make a profit or throw give.

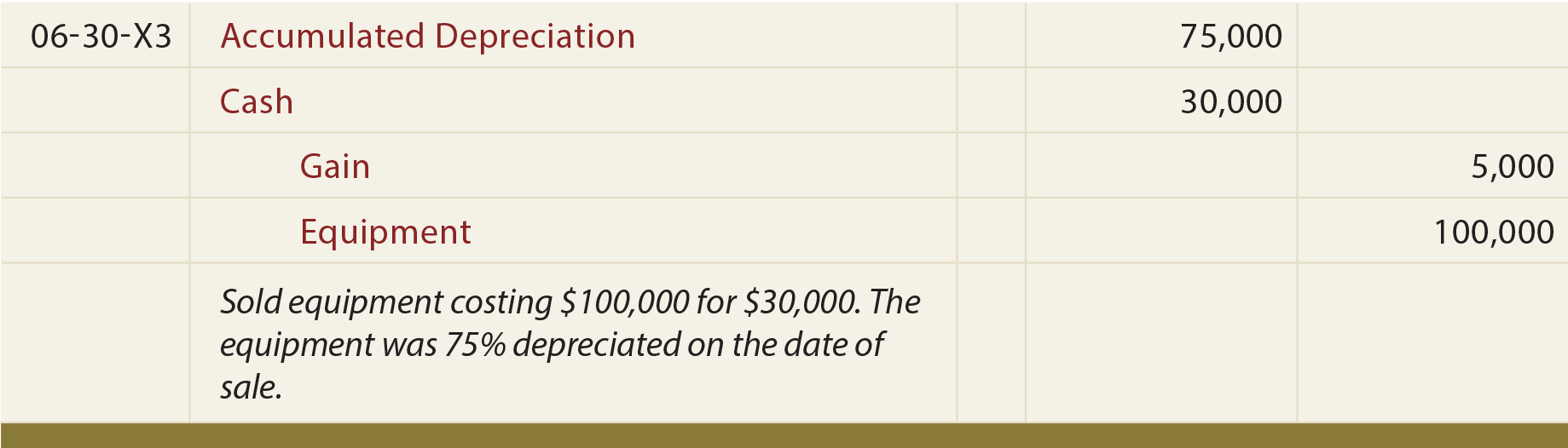

. JOURNAL ENTRIES FOR ASSETS DISPOSAL. How to Record Asset Acquisition Disposal. Heres the journal entry to record the sale of the asset.

Asset Accounts Liability Accounts Equity Accounts Revenue Accounts Expense Accounts. Nowadays businesses sell their assets as part of strategic decision-making. The journal voucher for this entire disposal is shown as follows.

In this case reverse any accumulated depreciation and reverse the original asset cost. To post a disposal from the fixed asset GL journal. In the final part of the question the asset is sold for 4500.

A debit increases the cash account which is an asset account. Asset disposal is the removal of a long-term asset from the companys accounting records. Journal entry for disposal of asset fully depreciated Fully depreciated asset without residual value.

And the journal entry is. Journal entry for recording repair and maintenance expenses. In general journal format the banks entry is.

Record the sale or disposal of an asset. The WIP accounting journal entry is an important category in accounting and must be included according to GAAP. In the case of profits a journal entry for profit on sale of fixed assets is booked.

Results of Journal Entry. We should take the accompanying guide to break down various circumstances that require resource taking care of. Disposal indicates that the asset will yield no further benefits.

Cash balance decreases by 1500. You sell your boardroom table for 20000. Choose the icon enter FA GL Journals and then choose the related link.

Read more its expected useful life and its probable salvage value at the time of disposal. If the asset is fully depreciated then that is the extent of the entry. These leases are capitalized and presented on the balance sheet as both assets and liabilities unless subject to any of the exemptions prescribed by the standard.

Therefore it represents the difference between that value and the assets carrying value. IFRS 16 directs lessees to calculate the ROU asset as the following. Instead you debit contract asset.

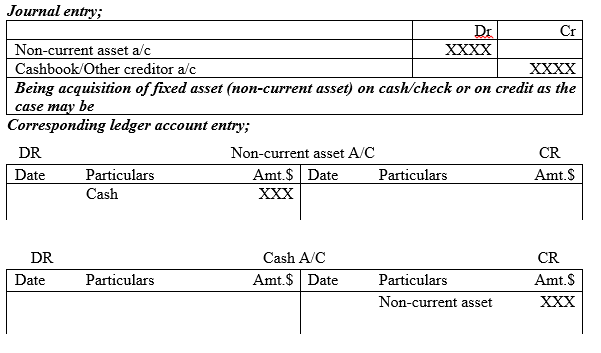

Throwing Giving it away. 14 Journal As with the acquisition of non-current assets the journal or journal voucher is used as the book of prime entry. Trustworthy Banks journal entry As the entry shows the banks assets increase by the debit of 100 and the banks liabilities increase by the credit of 100.

Click the asset number to open the asset details. -- Decrease in Assets. Cost of the asset.

Select the Registered tab. Since the asset had a net book value of 3000 the profit on disposal is calculated as follows. The journal entry for the disposal should be.

Debit cash for 40000 in a new journal entry. At that moment you have an unconditional right to a payment and not a contract asset of any kind. In the FA Posting Type field select Disposal.

Sale of an asset may be done to retire an asset funds generation etc. Enter the details of the disposal. Once an asset is used it depreciates over the useful life.

Journal Entry for Gain. Lets discuss this concept in detail with the help of examples. Such a sale may result in a profit or loss for the business.

The banks detailed records show that Debris Disposals checking account is the specific liability that increased. In each case the fixed assets journal entries show the debit and credit account together with a brief narrative. IAS 36 defines the recoverable value of an asset as the higher of its fair value fewer costs of disposal and its value in use.

The journal entry you make depends on whether the asset is fully depreciated and whether you sell it for a profit or loss. Depending on the value of the asset a company may need to record gain or loss for the reporting period during which the asset is disposed. We usually make the disposal of the fixed asset that is fully depreciated by completely discarding it when it has no residual value at the end of its useful life.

The destroyed asset or Inventory is credited. Description of Journal Entry. Create an initial journal line and fill in the fields as necessary.

Show how the journal entry for the depreciation expense will be recorded at the end of the accounting period on December 31 2018. Choose a field to read a short description of the field or link to more information. For example assume you sold equipment for 40000.

When we sell the table we write off the remaining balances in both Fixed Assets and Accumulated Depreciation in the general ledger. To stay informed and take advantage of all of the unique resources RFID Journal offers become a member today. Asset disposal requires that the asset be removed from the balance sheet.

Otherwise its not considered to be some logical analytic. 234 Date 4 July Prepared by Authorised by. How to calculate the right-of-use asset under IFRS 16.

A significant decline in the repair and maintenance expense can be justified when there is substantial disposal of the machinery. ABC Corporation buys a machine for 100000 and recognizes 10000 of depreciation per year over the following ten years. Journal Entry for Profit on Sale of Fixed Assets.

Only RFID Journal provides you with the latest insights into whats happening with the technology and standards and inside the operations of leading early adopters across all industries and around the world. There is a common misconception that depreciation is a method of expensing a capitalized asset. If it shows a debit balance this denotes a loss on the disposal of the fixed asset.

Lets consider the same situation as in scenario 2 but the selling price was only 500. In this case it is simply the removal of such fixed asset from the balance sheet. IFRS 16 also refers to the lease asset as a ROU asset.

The diary sections expected to record the disposal of assets rely upon the conditions wherein the occasion happened. Like all expense accounts this debit balance should be transferred to the debit of profit and loss account at the end of the year. Disposal by Asset Sale with a Loss.

The journal entry for insurance claims involves three account heads. Three Ways RFID Asset. In the Accounting menu select Advanced then click Fixed assets.

After making the above-mentioned entries the disposal of fixed assets account shows a debit or credit balance. Then you work for another 3 months you complete the project and hand it over to the customer. Accounting for Disposal of Fixed Assets.

Example of a Fixed Asset Disposal. After the assets useful life is over you might decide to dispose of it by. Commonly impairment describes a significant reduction in a fixed assets recoverable value.

Any difference between actual loss and the amount received from insurance companies is charged to the profit and loss account. Click Options then select Dispose. The difference between the book value of the asset and our sales proceeds is recognized as a gain.

Journal entries for insurance claim. Has an apparatus resource on its accounting report with a worth of. Profit on disposal Proceeds - Net book value Profit on disposal 4500 - 3000 1500 The fixed assets disposal journal entry would be as follow.

The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets.

Disposal Of Pp E Principlesofaccounting Com

Accounting Nest Advanced Acquisition And Disposal Of Non Current Assets

Journal Entries For Transfers And Reclassifications Oracle Assets Help

Journal Entries For Retirements And Reinstatements Oracle Assets Help

No comments for "Asset Disposal Journal Entry"

Post a Comment